Middle East Series: Infrastructure development 0 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

Development of the infrastructure in the Middle East has been a regional focus for international organisations like the World Bank and the IMF, judging from the number of documents generated. This region has been relatively underinvested with a large portion of the rural population being completely unserved by electricity and telecommunications, while services in urban areas often experience high distribution losses, frequent service interruptions, and weak financial performance.

When countries in the Middle-East talk about "adopting the Singapore model", you know that one focus has to be infrastructure, for that is one of Singapore's key strengths. Given the oil money flowing into the Middle-East, there have been large public infrastructure projects executed and new ones being planned for at least the next decade, with amounts running into the hundreds of billions. Infrastructure development is not only crucial in meeting the region’s social challenge, but has an essential contribution to make towards improving business competitiveness in the Middle East.

By infrastructure I mean public infrastructure, which can be classified into water, electricity, transport, sewerage, telecommunications, sanitation. Given that the region is now characterised by high monetary inflows (due to oil exports) and a rapidly growing population (more than doubled to about 270 million in the past 30 years, could double again in the next 30 years --- an annual growth rate of ~2.5%), the growth in infrastructure investments will obviously outperform most other areas of the world. The strategy has been shifting to more emphasis on private sector participation; an example is shown in today's Business Times which reports the Saudis seeking US$1 trillion from private sector investments to carry out various infrastructure projects (top four being oil & gas, petrochemicals, electricity and water, telecommunications) --- which offers tremendous opportunities for global engineering and construction companies (see Partnership Models Part 1 & Part 2 for various public-private partnership models).

I will choose to focus on two aspects of the infrastructure development which appear to offer the most opportunities for Singapore companies so far, by the track record of contracts offered/explored.

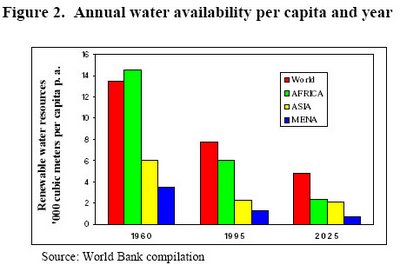

The water sector is a unique problem to the Middle East more than anywhere else, and it is evident from an examination of demand and supply. In terms of supply, the water availability per capita is historically the lowest among all the world's major regions, and this is expected to remain similar in the future.

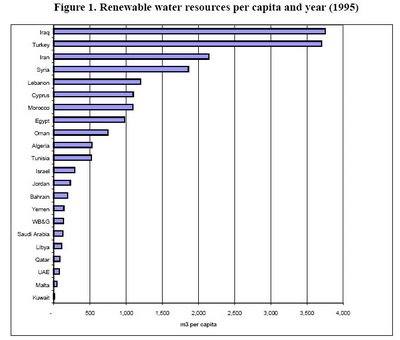

Among the various Middle-East countries, it is interesting to note that the rich Gulf countries are the ones that lack renewable (ie. natural) water the most: Bahrain, Saudi Arabia, UAE, Qatar, Kuwait --- suggestive because this implies that these countries offer the greatest opportunities for water infrastructure development.

On the demand side, many Middle-East countries have some of the highest consumption rates per capita in the world (eg. in UAE, consumption per capita is >3X the world average). High consumption rates are mainly driven by aggressive agricultural policies, which can account for >80% of a country's water usage, and further accentuated by high technical and commercial losses in the water systems, also referred to as unaccounted for water(UFW). Kuwait, Saudi Arabia and the UAE actually provide water for free.

Approaches to increasing water supply (over and above natural/renewable water sources) include tapping into groundwater, desalinating seawater, or by reusing wastewater. The first poses long-term environmental problems, the third only allows limited usage of the recycled water; the second option is expensive but is the top technological approach for increasing water supplies in the region for the richer countries, and is practised on a large scale in Saudi Arabia and in the Gulf countries (esp. UAE & Kuwait), where it contributes substantially to municipal and industrial water supplies. The Middle East nations operate 60% of the world's desalination plants, and it is estimated they will need to invest a $100 billion on desalination over the next decade if demand for water keeps growing at the current pace, especially in the Gulf region. To give a perspective, water infrastructure is probably the third most important infrastructural investment in Saudi Arabia for the coming years (US$80B over the next 20 years), after oil and gas (to be covered in a separate article) and electricity.

The second sub-sector is electricity and power. The IMF’s prediction is that the regional power sector will remain very buoyant for the coming year, in contrast to other parts of the world where demand is stagnant or growing slowly. This is due to continued strong regional economic growth. Demand in these richer GCC (Gulf Cooperation Council) countries is expected to experience double digit growth in the foreseeable future. In addition, reconstruction of Iraq’s electricity generation and distribution sector also provides promise.

Recent estimates are that $57 billion will be spent over the next six years in the Middle East & North African region on the installation of new capacity alone. where about half of this will be spent solely in the GCC (the richer Gulf countries), with the private sector to provide the majority of this. Among these, Saudi Arabia and the UAE are expected to provide the bulk of the contracts.

An overview of the current/future power/electricity investments as of early 2006:

- Different sectors within the energy industry in the Middle East will require investments of more than $1 trillion over the next 20 years

- The UAE’s power sector needs more than $10 billion investment to meet growing energy consumption demand

- The government of Saudi Arabia plans to increase generation capacity from 17,000MW to 66,000MW by 2023, requiring investments of $17 billion

- Investments required in other Middle East countries are estimated to be: $3.6 billion in Kuwait; $800 million in Oman; and $1 billion in Bahrain

Projected Additional Capacity needed by 2010

Bahrain - 1200MW at an estimated cost of US$900 million

Iran - 20,000MW at an estimated cost of US$10 billion

Jordan - 750MW at an estimated cost of US$445 million

Kuwait - 3,400MW at an estimated cost of US$2.5 billion

Lebanon - 350MW at an estimated cost of US$175 million

Oman - 1,100MW at an estimated cost of US$900 million

Qatar - 800MW at an estimated cost of US$600 million

Saudi Arabia - 20,000MW at an estimated cost of US$15 billion

United Arab Emirates - 6,600MW at an estimated cost of US$5.1 billion

These power/electricity generation projects tend to be huge. An example is the Dolphin Project, which involves the production and processing of natural gas from Qatar’s North Field, and transportation of the dry gas by pipeline to the UAE for electricity generation. Intended to fuel the UAE’s long-term industrial growth, it is worth billions of dollars. Another significant project is the GCC power grid --- a $3B project --- which is intended to serve as a common power grid to join the GCC nations: Saudi Arabia, Kuwait, Bahrain, Qatar, the UAE and Oman.

Due to the size of these contracts and the growing focus on public-private partnerships, foreign utilities players are vying for a piece of the pie. An example is Sembcorp Utilities, which recently had a bidding tussle with Suez Energy over a UAE power plant (it eventually went Sembcorp's way).

References:

(1) World Bank report Jan 2000: Urban Water and Sanitation in the Middle East and North Africa Region: The Way Forward

(2) Booz Allen Hamilton: Public-private partnerships keep Middle East water flowing

(3) Threat of water shortages sees Middle East governments focusing on increasing supply

(4) World Bank May 2005 Speech to World Economic Forum on Infrastructure Challenges

(5) Sep 03 report: Saudi to invest USD700 billion in infrastructure projects

(6) Jun 03 report: Middle East gears up for increased power demand and infrastructure development

(7) Sep 03 report: Inaugural ‘Middle East Infrastructure Innovation’ award goes to Dolphin Energy CEO

(8) Middle East Electricity Exhibition and Conference

0 Comments:

Post a Comment

<< Home