Middle East Series: Oil and Gas Infrastructure 0 comments

(P.S: Sorry for any disturbances the advertisements above may have caused you)

It may seem clear that of the four articles (including this one and excluding the introductory article) I've written on this region, three are on construction and infrastructure development. This is exactly my intention because construction and engineering are the prime areas for foreign participation; the Middle East is primarily an investment-driven boom. And what's more appropriate to end this series than with what the region is known for: oil and gas?

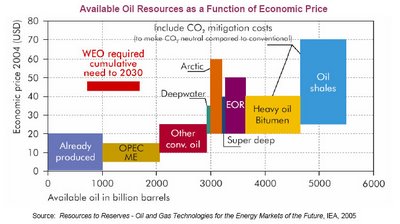

The Middle East countries form the core of the infamous OPEC cartel which supplies ~40% of the world's oil and effectively dictate world supply. A main reason for their dominance is that world supply is peaking (North Sea and Gulf of Mexico oil past their peaks) while Middle East oil reserves form >50% of the world's total and gas reserves form ~40% of the world's total. Indeed, in the medium term, they are likely to be the most important producers because there exist significant infrastructural (drilling equipment shortages eg. rigs, as well as transport infrastructure) constraints and even regulatory constraints due to economic nationalism being increasingly practised by countries like Russia and Venezuela. Middle East oilfields are mostly onshore and relatively easy to develop (a significant example being Saudi Arabia) and have incumbent government support and existing frameworks of cooperation with the big IOCs (integrated oil companies). The figure below shows how economically cheap Middle East oil is to exploit in relation to the rest of the options (viability measured by selling price of crude oil)

Saudi Arabia dominates crude oil production, and its national oil company (NOC) Saudi Aramco possesses the technological abilities to extract their oil. Their planned expenditure for oil and gas infrastructure is the top item among all infrastructure expenditure (including electricity and water --- see earlier article); not surprising since this is their critical sector. The bulk of Saudi expansions will come from onshore fields, for which prevailing global tightness in drilling capacity is less pronounced, so delays in obtaining rigs may be less prevalent than for other, notably non-OPEC, producers. Sustained production capacity increases are also seen in Algeria, Qatar (also gas-liquid investments to tap its huge gas reserves), the UAE (both onshore and offshore), and Kuwait, with active foreign company involvement. Iran, as the second largest oil producer, may see plateauing production due to technological difficulties, while Iraq still faces political problems. However, this of course suggests opportunities for more technically competent foreign operators should geopolitical tensions ease.

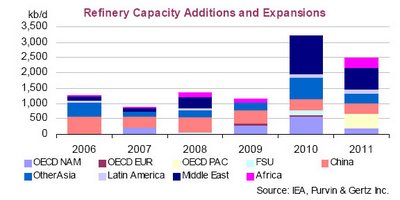

One of the bottlenecks in the global oil supply chain are the refineries and this is one of the key areas of oil and gas infrastructure development targeted by the Middle-East countries. In fact, the region is the largest contributor to refinery expansions over the next five years, driven by the aggressive expansion plans of national oil companies.

Given that Middle East oil is typically sour crude which means complex refineries are needed for processing, I initially thought these would be the type primarily planned for construction. It turns out a combination of both crude distillation refineries (less complex) and complex hydrocracking refineries (complex) are planned for construction. The former are for domestic power generation for rapidly growing populations, while the latter are for international export. Major additions are planned across the region, from Oman, Yemen and Iran before 2010 and a number of world-class facilities in Saudi Arabia, Kuwait, the UAE and Qatar post-2010 (hence explaining the figure above). It is worth noting that the near-term refinery expenditure is mainly in the form of upgrading and environmental compliance (desuphurisation), while after 2008 the real new refinery additions will start building/coming onstream (for those timing the refinery build cycles).

The third main area of investment would be in distribution facilities, with investments in oil terminals and pipelines. Given the tightness in the export market, the charter rates for oil tankers and VLCCs (Very Large Crude Carriers) have remained strong even as bulk and container shipping rates have foundered; some Middle East countries are building new oil tankers to ease transportation constraints (eg. Kuwait Oil Tanker Company) and also LNG carriers are being built in Asian shipyards.

The theme is one of Middle East countries investing aggressively to expand capacity and ease bottlenecks along the entire supply chain, and those companies with exposure to the oil and gas industries in this region are set to benefit, particularly in the areas above which have proven to be major areas of planned expenditure.

As an indication of the growing economic importance of the Middle East, the Business Times is now covering it as a separate region. It will pay to track the news in this region, because it is likely to be where the liquidity is coming from in the near to medium-term. As it is, the export surplus of these countries have already grown comparable to Asia's on a region-to-region basis as a result of high oil prices.

References:

(1) IEA report Jul 2006: Medium-Term Oil Market Report

(2) BusinessWeek Online Mar 2006: The New Middle East Oil Bonanza

(3) MEES article Mar 2002: World Energy Outlook: A Middle East Perspective

(4) Middle East Online article Dec 2005: Kuwait to pump 44 billion dollars into oil

(5) Gulfnews.com Jun 2006 report: Arabian Gulf VLCC rates rise sharply

0 Comments:

Post a Comment

<< Home